401k cash out penalty calculator

Among the provisions of this act were some situations which allow for penalty-free withdrawals from your 401k in 2020 due to COVID-19. The Long-Term Consequences of a 401k Cash Out.

401k Calculator Withdrawal Outlet 50 Off Www Visitmontanejos Com

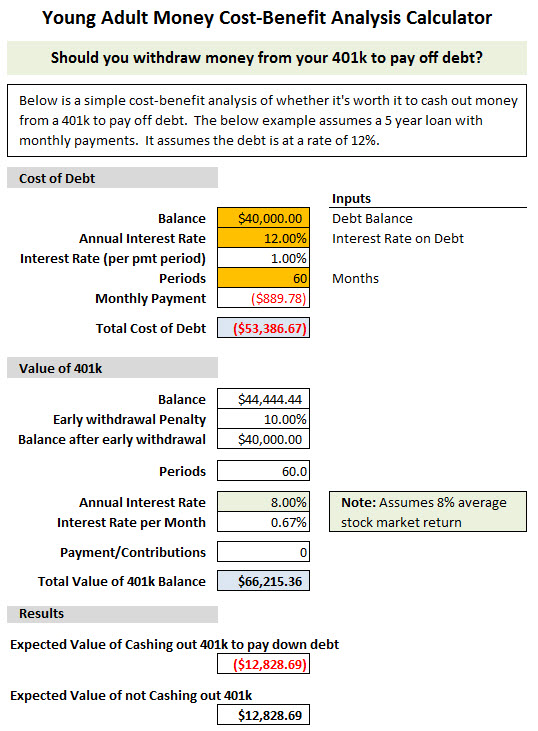

But again this is not a decision to be taken lightly.

. Taking a lump sum payment from your exs retirement account as part of the property settlement is one way to get access to cash. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. Here are 3 ideas for tracking down a lost 401k from a former employer.

The 401k plan is a retirement savings plan that is sponsored by your employer. Whenever you earn your monthly pay part of that money goes into your 401k plan 401a plan or whatever package you get to be accessed when you finally decide to retire. Many people going through divorce need cash for a down-payment on a new house or to cover living expenses before finding a job.

Try the H. Still there might come a. How to Cash Out a 401k Posted by Frank Gogol Updated on August 27 2022.

Apart from the fact that you will probably have to pay a 10 penalty you will also need to pay back the full amount with interest. If you return the cash to your IRA within 3 years you will not owe the tax payment. Roth contribution withdrawals are generally tax- and penalty-free as long as the withdrawal occurs at least five years after the tax year in which you first made a Roth 401k contribution and.

The easiest and most effective method for locating an old lost 401k is to contact your former employers. Tax Refund Schedule Dates 2021 2022. Due to the financial crisis created by the Coronavirus pandemic the CARES Act was signed into law by President Donald Trump in March 2020.

Ask the human resources or accounting department to check their plan records to see if youve ever participated in the 401k plan. 401K and other retirement plans. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

Taking cash out of your 401k plan before age 59 ½ is considered an early distribution Federal Income Tax Rate Estimate your marginal Federal income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. Generally taking money from a 401k before the age of 59 ½ would have a 10 penalty fee.

401 K Withdrawal Calculator Nerdwallet

401k Calculator Withdrawal On Sale 53 Off Sportsregras Com

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Beware Of Cashing Out A 401 K Pension Parameters

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator

401k Calculator Withdrawal Outlet 50 Off Www Visitmontanejos Com

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

401k Calculator Withdrawal Outlet 50 Off Www Visitmontanejos Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Should You Withdraw Funds From Your 401k The Ifw

401k Calculator Withdrawal Outlet 50 Off Www Visitmontanejos Com

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

401k Calculator Withdrawal On Sale 53 Off Sportsregras Com